Looking for a hassle-free way to file your taxes this year? Blank printable 1099 forms might just be the solution you need. These forms allow you to report various types of income, such as freelance earnings or rental income, to the IRS.

With blank printable 1099 forms, you can easily fill in the necessary information and submit them along with your tax return. These forms are essential for independent contractors, freelancers, and small business owners who receive income that isn’t subject to automatic withholding.

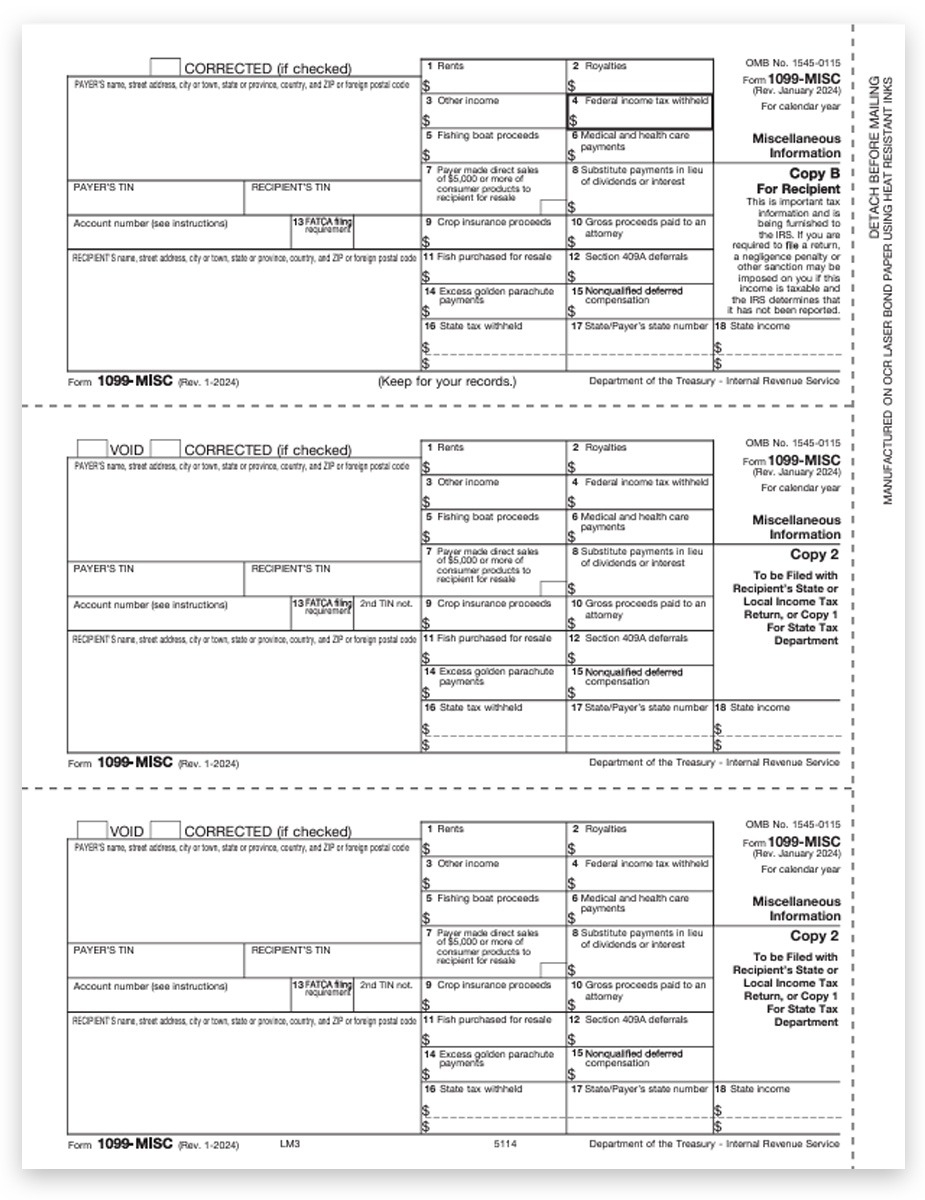

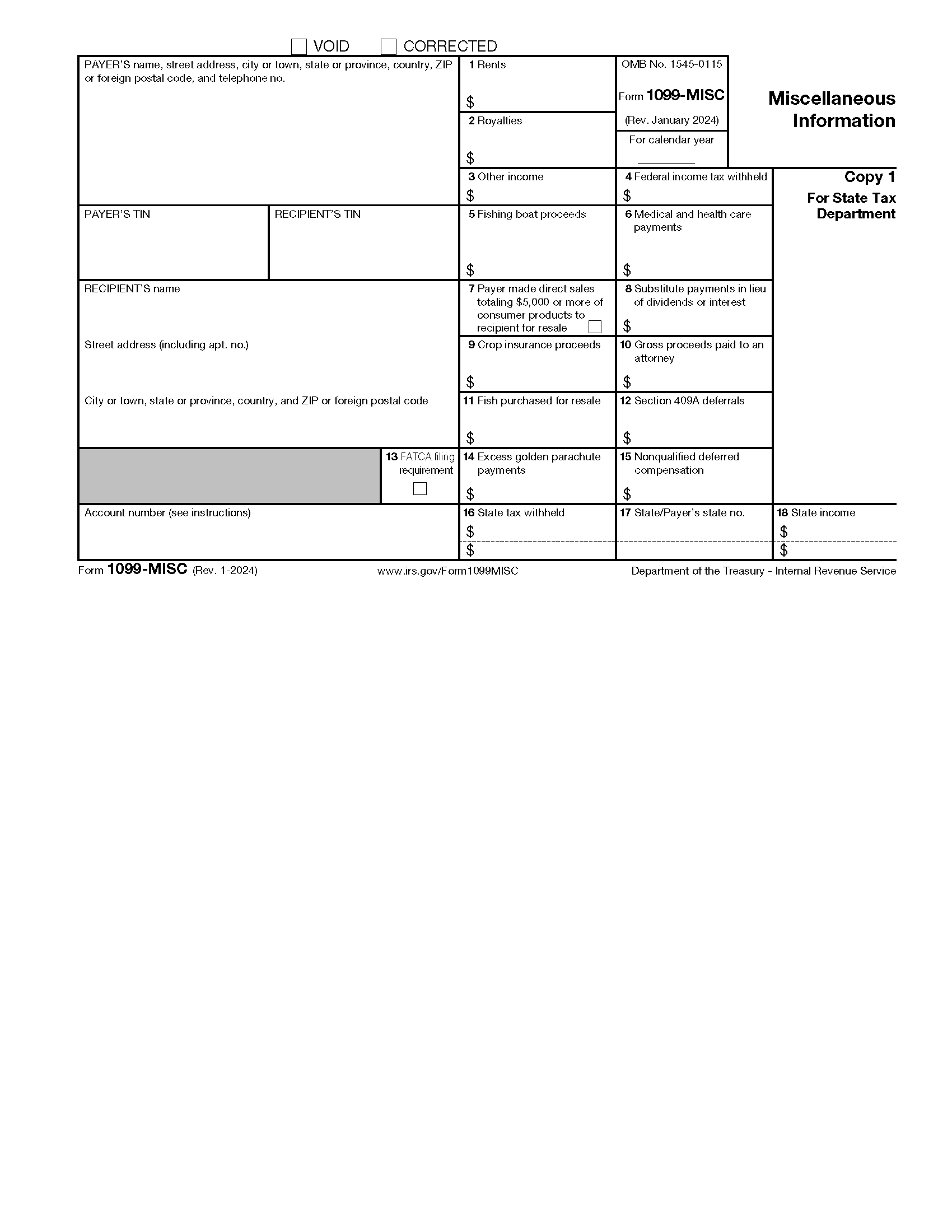

Blank Printable 1099 Forms

Blank Printable 1099 Forms: A Convenient Tax Filing Tool

By using blank printable 1099 forms, you can ensure that your income is accurately reported to the IRS. These forms help you avoid potential penalties for failing to report income and provide a clear record of your earnings throughout the year.

Whether you’re a gig worker, a landlord, or a small business owner, having access to blank printable 1099 forms can simplify the tax filing process. These forms are easy to download, fill out, and submit, making it easier than ever to stay compliant with tax regulations.

Don’t let tax season stress you out. Take advantage of blank printable 1099 forms to streamline your tax filing process and ensure that your income is reported accurately. With these forms at your fingertips, you can file your taxes with confidence and peace of mind.

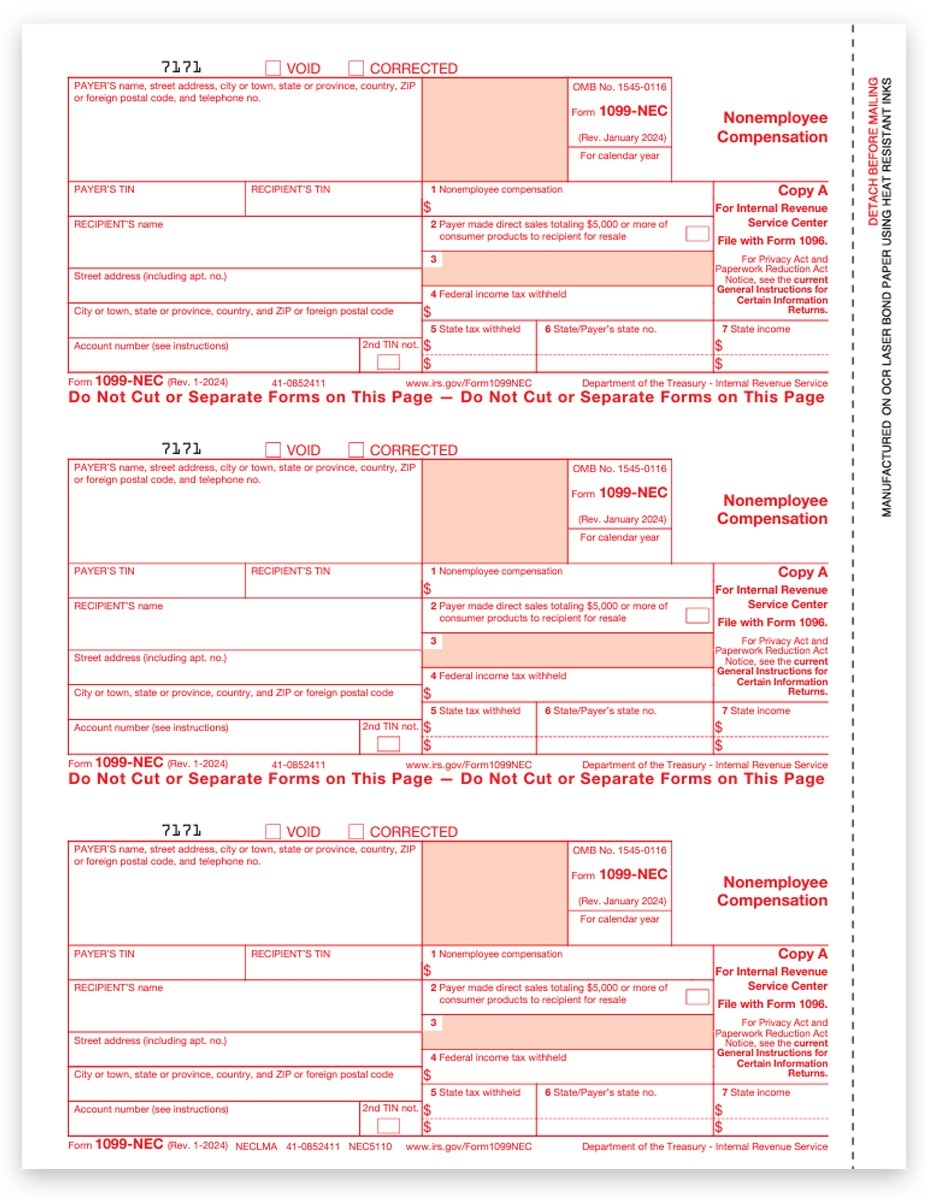

1099 NEC Forms Copy A For IRS Federal DiscountTaxForms

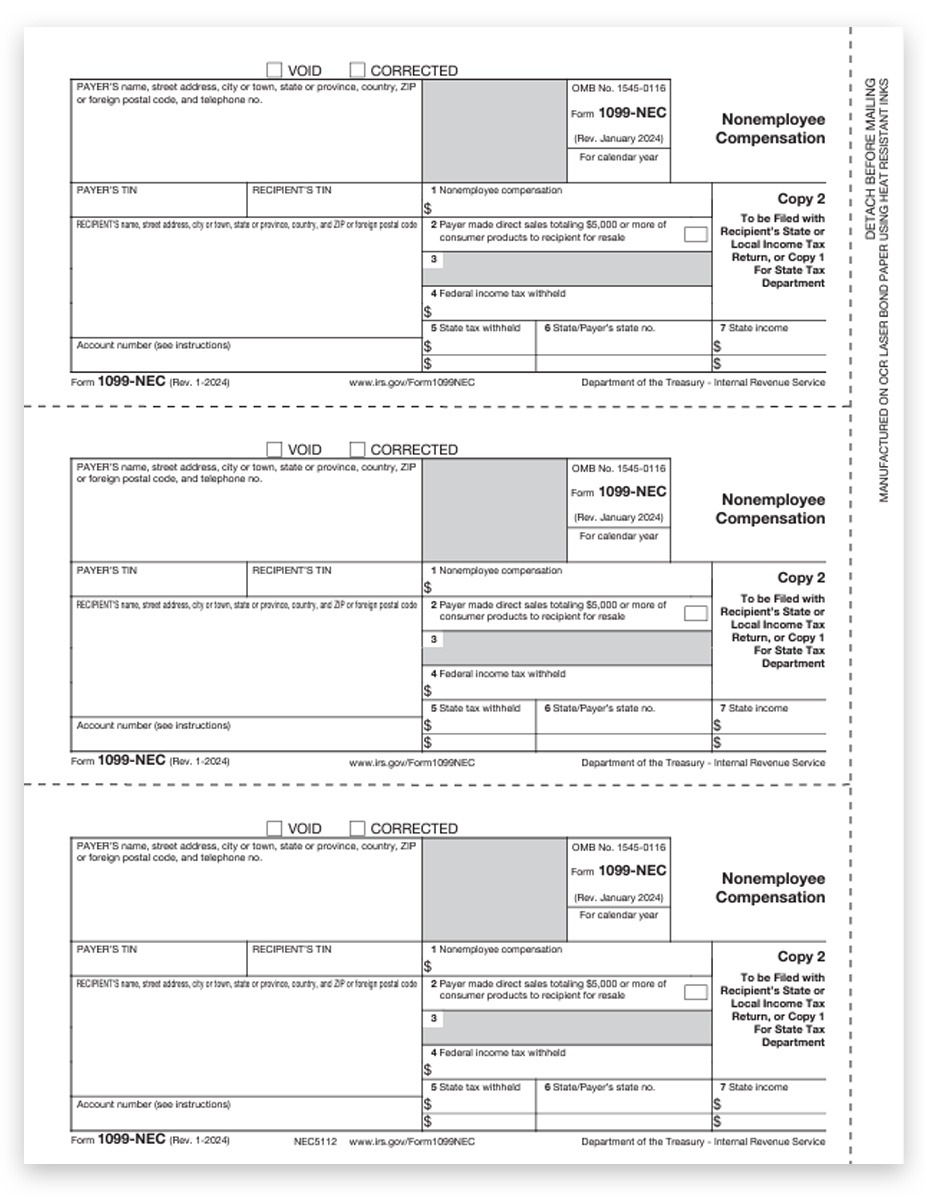

1099 NEC Forms Copy 2 For Payer DiscountTaxForms

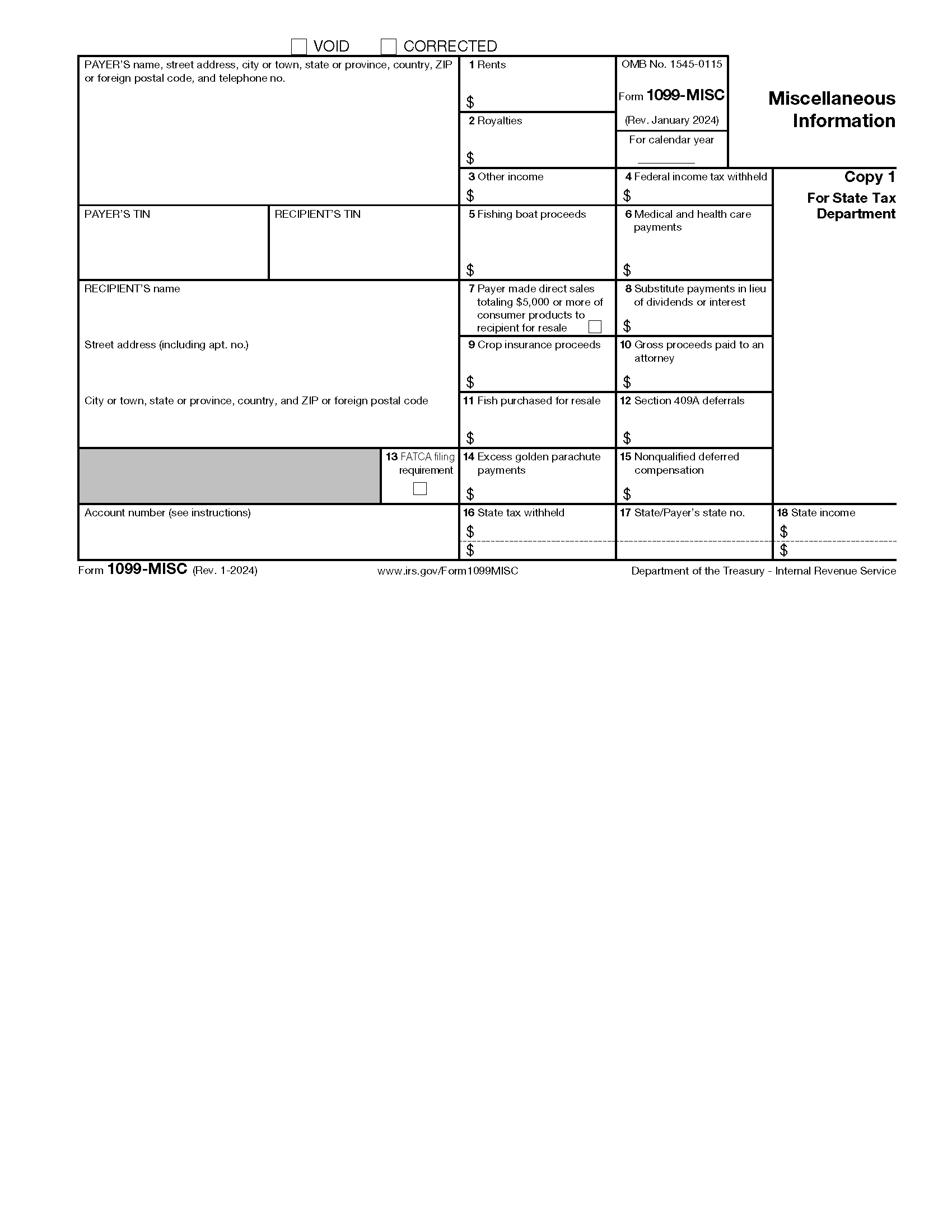

Free IRS Form 1099 MISC PDF EForms

Free IRS Form 1099 MISC PDF EForms

Free IRS 1099 Form PDF EForms